Self-directed investors

Already own a few stocks and want real research without reading hundreds of pages.

- Uses a brokerage app and wants clarity, speed, and source links.

- Comfortable with AI tools but expects transparent methodology.

Educational research for U.S. stocks

We summarize 10-K and 10-Q filings into plain-English insights, highlight key risks and trends, and link everything back to the original source.

Educational only. Not investment advice. U.S. stocks only.

Built from public SEC filings with direct links to EDGAR.

Nothing is hidden

Every insight stays tied to the original SEC filing so you can double-check the source yourself.

A snippet pulled directly from a recent 10-K—risk factors, management discussion, or key disclosures written by the company.

Plain-English context that explains what changed and why it matters for understanding the business.

Links back to the exact EDGAR section.

Open SEC EDGARHow it works

We pull U.S. filings directly from SEC EDGAR, keep context intact, and keep you anchored to the source. Want more? See the methodology overview.

We pull public 10-K and 10-Q filings directly from the SEC’s EDGAR database.

Key financial disclosures and risk factors are parsed and organized into consistent, easy-to-read categories.

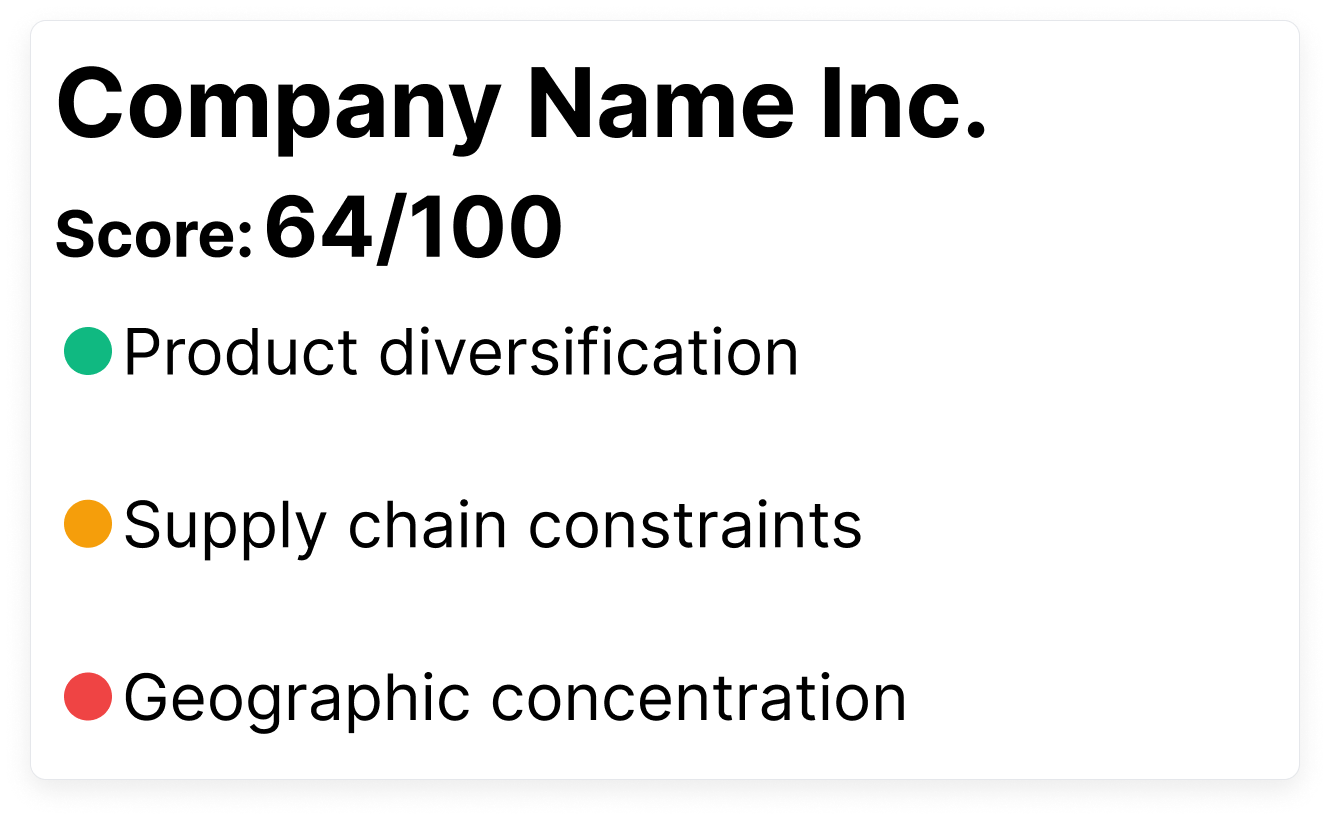

You receive an educational risk scorecard with direct links back to the original filing.

Who it’s for

Already own a few stocks and want real research without reading hundreds of pages.

People who read filings or model companies but need a faster way to spot what changed.

Plain-English summaries of 10-K/10-Q filings with filing-backed context.

See a sample scorecard10-K/10-Q distilled into highlights you can review quickly while staying close to the source.

View parsed 10-K demoUnderstand what shifted and why—with every point linked back to EDGAR.

Get notified when new 10-K/10-Q filings post so you can review the changes yourself.

What Veilscope is / isn’t

No. Veilscope is an educational tool for U.S. stocks. Investing involves risk and you are responsible for your decisions.

From the U.S. SEC’s EDGAR system. We focus on public company filings (10-K/10-Q, etc.).

We extract key disclosures and risks from filings, organize them into consistent factors, and link each point back to EDGAR. It’s designed for learning, not recommendations.

Create a free account to explore a sample risk scorecard built from SEC filings.

Educational only. Not investment advice. U.S. stocks only. Data from SEC EDGAR.